Research into GHG Emission Data from BRSR 2023: Business Case for Indian Companies to go for External Assurance

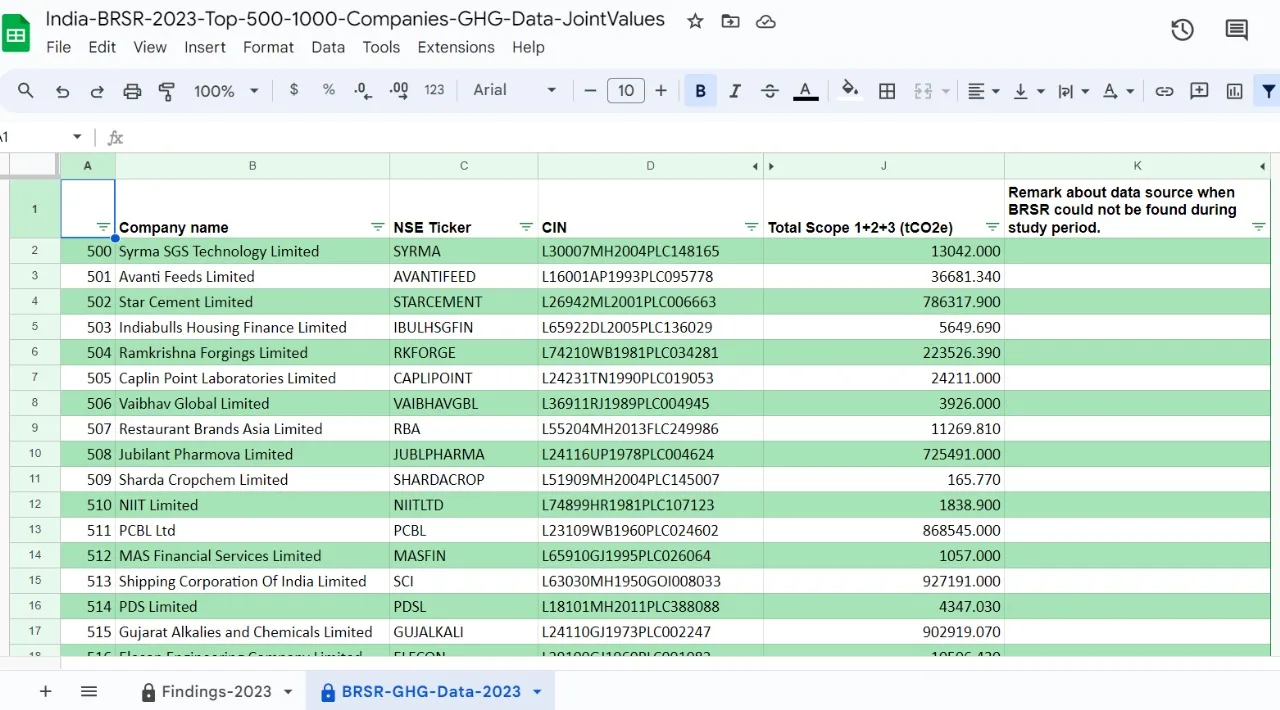

Based on market capitalisation in India, the top 1000 listed companies are mandated by the Securities and Exchange Board of India (SEBI) for their ESG performance disclosures in the Business Responsibility and Sustainability Reporting (BRSR) format. This research delved into GHG emissions, Board Diversity, Waste Disposal, and other critical performance data manually collected from BRSR for 2023 for the top 1000 companies list published by the National Stock Exchange (NSE).

This article is published based on the findings of the first round of analysis of GHG data for companies ranked from 500 to 1000 in the NSE’s list. A link to the data is provided in this article. Additional data for company-wise scope-1, scope-2, and scope-3 emissions and other vital parameters are reserved for further analysis, which will be considered for addition to the file linked here.

Data Analysis and Findings:

- These 500 companies in the data set reported a combined 213.2 million tCO2e.

- Scope-1 emissions constitute 73% of the total reported emissions, while Scope-2 emissions represent 13%.

- Out of the 500 companies, 347 have reported Scope-1 emissions, and 339 have reported Scope-2 emissions in figures over zero. The remaining companies reported their GHG emissions as “Nil” or “NA”.

- Certain companies not reporting Scope-1 or Scope-2 emissions offer unique reasons. These reasons include a commitment to becoming carbon neutral, non-existent emissions, banking activities with no emission chance, absence of company-owned premises, and difficulties in data collection.

- A positive highlight is the leadership exhibited by 49 companies in the present dataset 500 that have voluntarily reported Scope-3 emissions. Some companies have shown leadership by reporting their GHG emissions in tCO2e/turnover unit.

- Out of the 500 companies in this study, only 46 have chosen ‘consolidated’ reporting.

Relevant Regulatory Framework Background:

The format of BRSR released in July 2023 by SEBI required companies to disclose reporting boundaries, clarifying whether reports are on a standalone or consolidated basis. The guidance note from May 2021 stresses the need for consistency in reporting boundaries across the BRSR.

The implementation schedule for BRSR Core with reasonable assurance will be gradual, with the top 150 listed entities undergoing assurance for 2023-24 reporting, followed by the top 250 entities in subsequent years and covering 1000 companies by 2026-27.

SEBI has also required ESG disclosures for the value chain of certain listed companies, which are required to report relevant KPIs from the BRSR Core for their value chain, covering their primary upstream and downstream partners that collectively account for 75% of their purchases or sales. ESG disclosures for the value chain will apply to the top 250 listed entities on a comply-or-explain basis from 2024-2025, with limited assurance that these disclosures will be required from 2025-2026.

Observation and Discussion:

Looking at the ‘nil’ reporting for scope 1 and scope 2 emissions by close to 30% of the companies and the fact that 90% of companies in this study universe are found adhering to BRSR reporting on a ‘standalone’ basis, it is logical to hypothesise that holding companies reporting on standalone basis do not often contain all operations that cause GHG emission. In such companies, a BRSR reports on a ‘consolidated’ basis (including their subsidiaries) with limited assurance, which may give a different picture covering their actual GHG emissions.

It is crucial to note that the inclusion of these companies in the top 1000 list was based on shareholders valuing their shares, considering the comprehensive value held by their subsidiaries’ business as of March 31, 2023. In such a case, the standalone reporting by these companies may comply with SEBI requirements; however, it does not provide complete information about their emissions commensurate with the expectations of their investors.

In the given regulatory framework background as above, a ‘nil’ or not reporting the scope 1 and scope 2 emissions by the number of listed companies in this dataset justifies a requirement for a faster rollout of the requirement for external assurance on a limited basis to cover all 1000 companies. Leaving the companies already mandated for reasonable assurance from 2023-24, a limited assurance to cover all 1000 listed companies may establish full credibility to the data reported by these companies and provide confidence to their investors.

Also, suppose the companies on the lower rung of the top 1000 ranking suo-moto disclose their ESG performance in BRSR format on a ‘consolidated’ basis and minimum limited assurance. In that case, they are likely to get a strategic advantage in the business case, for example, corporate sustainability communication for their suo-moto drive and winning the confidence of their investors. A minimum limited assurance may reveal the gaps and scope for improvements, leading to streamlining training and in-house capacity-building efforts.

Last but not least, as the leading 250 companies in India gear up for ESG disclosures, including their value chain and external assurance, in line with recent SEBI directives, they will likely mandate verifiable GHG data from their suppliers. These top 500 to 1000 companies, often direct exporters and also serving as suppliers to the leading 250, can gain a strategic edge by reporting BRSR on a consolidated basis with limited assurance.

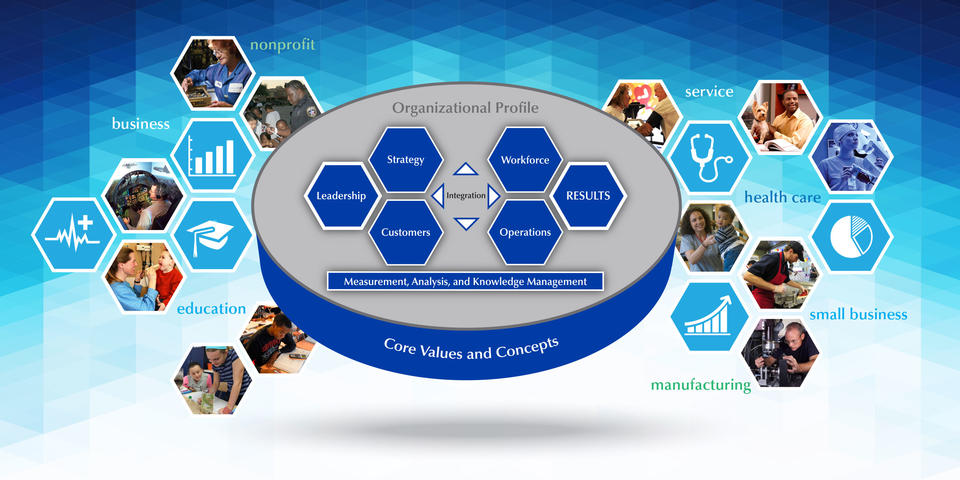

JointValues is set to offer synergistic support to catalyse the sustainability journey and elevate BRSR reporting for these entities.

Here is the link to the datasheet, which can be used to make your custom filter view.

JointValues | ESG Research, Training, Consulting, and Assurance

- Website: www.jointvalues.com

- Email: [email protected]

- LinkedIn: JointValues LinkedIn

Disclaimer: This data is collected manually for industry sector-specific study by professionals and students for academic and bonafide purposes. It does not constitute “environmental, social, and governance ratings” or “ESG ratings.” The information is provided for general informational purposes, and while efforts are made to ensure accuracy, no representations or warranties are made. Any reliance on this information is strictly at your own risk. We will not be liable for any loss or damage arising from the use of this site.

AUTHORS

Praveen Anant

Vishal Kaushik

Gini Elizabeth

Vedanshi Singh

CONTRIBUTORS

The following specialists in the specific domains of sustainability have contributed to this article by providing critical reviews and comments, helping authors to improve the observation and discussion in this article.

Senior Chartered Accountant and Assurance Provider

Usha Pillai