We are Amplifying Sustainability.

We are Amplifying Sustainability.

Our daily choices - the cars we drive, the gadgets we use, the lifestyle we maintain - reflect our values. And our values are greatly influenced by societal norms.

Our consumption has surpassed nature's renewal capacity by 1.8 times, triggering environmental crises like climate change and biodiversity loss. These crises are weakening the economic, social, and environmental threads in the fabric of sustainability, which is the base for thriving businesses, happy societies, and a habitable planet for generations to come.

And here comes JointValues with the Purpose of Amplifying Sustainability. We catalyse positive change to empower businesses, communities, and individuals to solve the problems of people and the planet profitably.

Our strategy, encompassing the following, propels us towards our purpose - to Amplify Sustainability.

1️⃣ Catalyse positive change to empower businesses, communities, and individuals to solve the problems of people and the planet profitably.

2️⃣ Partner in leveraging ESG frameworks and circular economy best practices for sustainable products and services and building enduring brands.

3️⃣ Synergize with stakeholders for innovation in achieving the Sustainable Development Goals (SDGs) and Lifestyle for Environment (LiFE).

4️⃣ Support enterprises in identifying and integrating material ESG issues into management systems, fostering business excellence.

5️⃣ Facilitate organizations in their value creation journey and sustainability impact communications enhancing corporate citizenship.

We differentiate ourselves while delivering Our Services. We go beyond advisory. From the ESG strategy blueprint to its execution, we are ready to catalyse your sustainability journey. We are not just consultants, but creators of a sustainable culture. We come where trust matters. We uphold no conflict of interest for assurance audits and non-audit services.

Learn more About Us, to have a closer look at our Vision, Mission, Values, and Ethics and explore the possibilities of synergic collaborations.

OUR ACTIONS

What we do and our presence span the following areas:

ESG Services

With a focus on Assurance, Consulting, Training, and Contract Operations, we differentiate ourselves by customizing sustainability assurance and consulting solutions.

Check Our Services

ESG News Media

We have proudly invested in ESG BROADCAST, a leading news and broadcasting platform which harnesses the power of ESG to Advance Sustainability.

Explore ESG BROADCASTESG AWARDS

We organize the prestigious JointValues ESG Awards, aligned with topic-specific international standards recognizing outstanding achievements by companies and individuals.

Learn MoreResearch and Studies

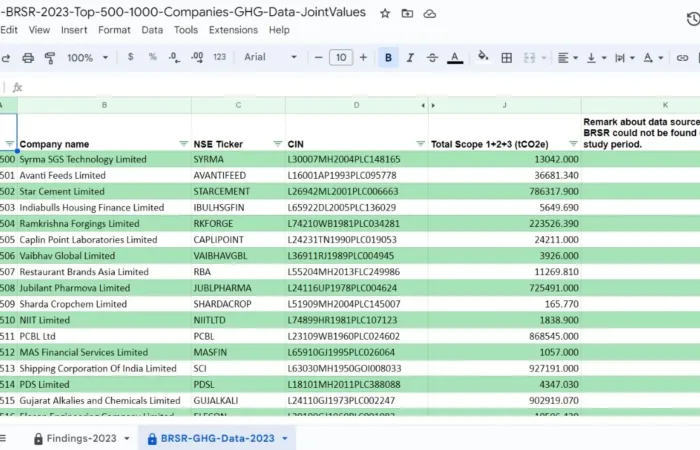

Navigate the ESG risks for your investment portfolio! We specialise is sustainable technologies and ESG data research, supporting leading institutions in effective de-risking strategies.

Learn More

Co-foundation and Incubation

Through our co-foundation and incubation initiatives, we invest in sustainable ventures while providing mentorship and support.

ExploreJoint Ventures with Academia

JointValues is working in close partnership with academia across diverse fields to equip future leaders with the expertise required to catalyze sustainable growth.

Learn MoreOur practices adheres to best frameworks and standards.